- D/618/7406 Unit 5: Challenges of IT Security in Modern Organizations – Risks, Solutions & Best Practices

- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

6008LBSBSC: UK Oil Plc is involved in upstream, oil exploration and production in the North Sea, United Kingdom: Strategic Corporate and Project Finance Assignment, LJMU, UK

| University | Liverpool John Moores University (LJMU) |

| Subject | 6008LBSBSC: Strategic Corporate and Project Finance |

Company Background

UK Oil Plc is involved in upstream, oil exploration and production in the North Sea, United Kingdom.

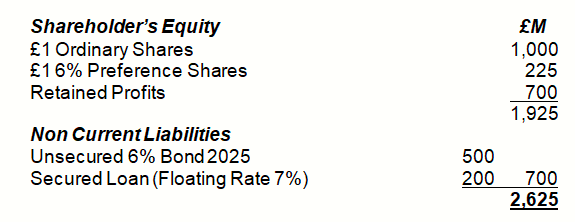

Their current finance structure is detailed below:

Last year’s Profit Before Tax was £500Mand this level of profit is expected to continue from existing business, at least in the short term.

Ordinary shareholders have previously received the following dividends:

- 3 years ago – 5%

- 2 years ago – 6%

- 1 year ago – 6.5%

Current Market Price Per Ordinary Share: £3.50

Future Strategy

The Board of UK Oil is considering its future strategy.

Despite the challenges facing the sector, (declining UK oil reserves, volatile oil prices, pressure from US shale producers, volatile demand, coupled with a high-cost base and environmental risks), the Board feel they must invest in order to grow the business.

The Board is willing to invest up to £350 million and requires your evaluation of the following potential Project, together with evidence-based, justified recommendations:

The Development & Operation of a New Oil Reservoir in the North Sea

Activity A: Geological Studies

Geological studies lasting 12 months have just been completed at a cost of £20 million.

Seismic and geological studies have cast doubt on the amount and quality of oil available for extraction, i.e.it may not provide 8,000,000 barrels per annum for 25 years as initially thought.

- Undertake the investment immediately in the hope that the amount and quality of oil are available. However completed studies estimate that there is only a 35 chance that the amount and quality of oil suggested, is available for extraction.

- Carry out Further Tests(which would delay the Board’s decision by 1 year and cost $50M) and then decide whether or not to drill. The estimated probability of the test yielding positive results is 0.30, in which case there would be a 70 probability of success. If the tests are negative there is then only a 0.20 chance of success.

This may also give time to form a Strategic Alliance with a partner(operational and/or financial), to share cost, risks and know-how. The form of Strategic Alliance has yet to be decided.

- Sell the Drilling Rights to a third party (another oil company):

- either immediately, for US$ 45 million, or

- after the Further Tests, (together with the Test Results) for:

- US$140 (assuming the tests were positive), or

- US$ 20 (if the tests prove negative)

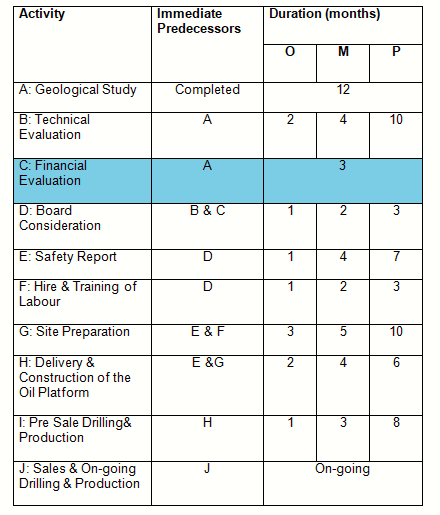

The project is now entering the Technical & Financial Evaluation Stage, Activities B & C

Activity B: Technical Evaluation

Production & Chemical Engineers will be asked to evaluate the feasibility of the project over the next 3 months

Activity C: Financial Evaluation

Your task is to present a Financial Evaluation & Recommendations to the Board in 3 months’ time to assist in their decision-making. In this respect you should base your initial assessment on 8,000,000 barrels per annum for 25 years.

Activity D: Board Consideration

The Board will consider both the Technical & Financial Evaluations before making their decision whether or not to proceed with the project.

Should the Board decide to proceed the Project will move on to Activities E through to J as detailed below

Activity E: Safety Report

A shortage of safety engineers in the sector may well prove critical to the timely start of the project, though this could be solved by moving suitably qualified staff from other activities, though it is uncertain whether this action would then delay the project.

Activity F: Hire & Training of Labour

Activity G: Site Preparation

Associated costs of Activities F & G are included in “Other Costs” detailed below

Activity H: Delivery & Construction of the Oil Platform including Drills, Pumps, Pipelines, etc

Two suppliers have been identified, British Oil Machinery which has quoted £315,000,000, and Munchen Machinery Germany which has quoted €350,000,000.

CAPEX will of course be eligible for any Tax Allowances.

Details of the contract have yet to be agreed but UK Oil will clearly need to reduce the risks associated with the tender and performance of the contract, particularly as both contractors may require an advanced payment of 10%.

Do You Need Assignment of This Question

hire online assignment writer UK on 6008LBSBSC: Strategic Corporate and Project Finance. our experts are highly educated to provide the well researched solution on finance assignment as per university guideline at a most reasonable price.