- D/618/7406 Unit 5: Challenges of IT Security in Modern Organizations – Risks, Solutions & Best Practices

- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

AC4052QA Elwira Ventures: The following trial balance was extracted from the books of Elwira Ventures: Financial Accounting Assignment, LMU, UK

| University | London Metropolitan University (LMU) |

| Subject | AC4052QA Financial Accounting |

Question 2

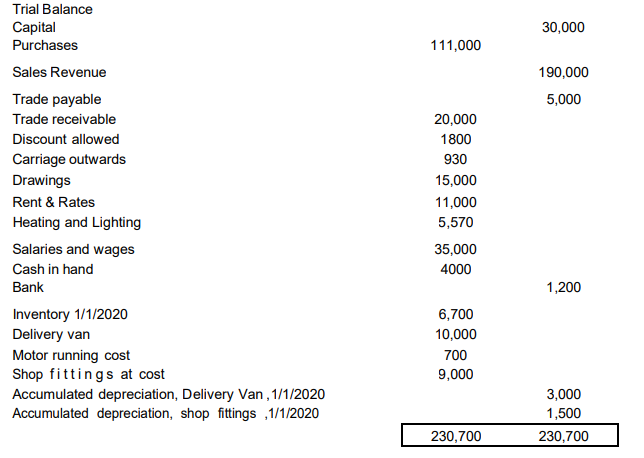

Elwira Ventures

The following trial balance was extracted from the books of Elwira Ventures, a spare parts merchant, at the close of business on 31 December 2020

Do You Need Assignment of This Question

Additional Information

1. Inventory on 31 December 2020 was £3,400.

2. Elwira took out spare parts costing £500 for the repair of her private car.No

payment was made for these goods.

3. Rent prepaid on 31 December 2020 was £1,200.

4. Motor running expenses owing on 31 December 2020 was £90.

5. Provide for depreciation on 31 Dec 2020 as follows: Delivery Van 45% on the reducing balance basis and Shop fittings 35% on the straight-line basis.

Required:

a) Draw up Elwira Ventures income statement for the year ended31December2020

b) Draw up Elwira statement of financial position as at 31 December 2020

c) In one sentence, state the effect of the following on income statement andstatement of financial position.

i. Prepaid income.

ii. Prepaid expense.

iii. Accrued income.

iv. Accrued expense.

Buy Answer of This Assessment & Raise Your Grades

Are you a student at London Metropolitan University (LMU) struggling with your AC4052QA Financial Accounting assignment? Look no further! We specialize in providing top-notch assignment writing help UK services tailored to meet the academic needs of LMU students. Our expert team is well-equipped to assist you in tackling challenging topics like the trial balance extracted from the books of Elwira Ventures.

Say goodbye to academic stress and excel in your Financial Accounting course with our reliable Accounting Assignment Help specifically designed for LMU students. Trust us to guide you through your coursework, allowing you to focus on your studies while we handle the intricacies of your assignments.