- D/618/7406 Unit 5: Challenges of IT Security in Modern Organizations – Risks, Solutions & Best Practices

- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

BA30592E: David Green is going to set up a sole trader business as a Decorator He knows that he would be personally responsible for his business’s debts: Recording Business Transaction Assignment, UOWL, UK

| University | University of West London (UoWL) |

| Subject | BA30592E: Recording Business Transactions |

- Learning outcomes

Part A

- David Green is going to set up a sole trader business as a Decorator. He knows that he would be personally responsible for his business’s debts. He also would have some accounting responsibilities; however, he does not know about the steps for starting a business. As your area of studying is related to Business, he wants you to consult him in this matter.

- Accounting involves recording, analyzing, and summarising the transactions of an entity to provide information for decision making.

Part B

- F Polk, after being in the Bakery business for some years without keeping proper records, now decides to keep a double-entry set of books. On 1 September 2021 he establishes that his assets and liabilities are as follows: Assets: Van £5,700, Fixtures £2,800, Stock £5,200, Debtors – P Mullen £105, M Abel £311, Bank £1060, Cash £85. Liabilities: Creditors – Syme Ltd £229, A Hill £80.

He is not sure about Journal entries for the following transactions in September 2021 as follows:

- Sep 1: A debt of £105 owing from P Mullen was written off as a bad debt

- Sep 5: Office Fixtures originally bought by credit for £150 was returned to the supplier Syme Ltd., as it was unsuitable. The full allowance will be given for this.

Recording Business Transactions BA30592E - Step 10: The business is owed £311 by M. Abel. He is declared bankrupt and we only received £180 cash in full settlement of the debt.

- Sep 18: Bought a Machinery from Brown Ltd. to use in the company. The total purchasing value of the machine is £1,800. The owner paid £100 cash, £500 by issuing a cheque, and the rest of the purchasing value would remain as credit.

- Sep 26 The owner paid half of the machinery debt to Brown Ltd. by issuing a cheque.

- Sep 28: The owner paid £130 an insurance bill via cheque thinking that it was in respect of the business. We now discover that £70 of the amount paid was in fact insurance of our private house.

Do You Need Assignment of This Question

- On 1 August 2021, the owners of the ABC Enterprise, Maurice & brothers, decided that they will boldly go and keep their records on a double-entry system. Their assets and liabilities at that date were. Their assets and liabilities at that date were: office fixtures £1200, a van £32,000, and £36,800 in the bank account. They have no liabilities at the 1st of August 2021

Their transactions during August 2021 were as follows

- Aug 2 Maurice & brothers received a loan of £12,400 from Santander Bank and they deposited it in their bank account.

- Aug 3 The amount of £2800 was transferred from the Bank Account to the Cash and hand account.

- Aug 4 Bought a second-hand Van paying by cheque £6,200

- Aug 5 Bought office fixtures £3400 from Sharp Office Ltd. They paid £1000 by issuing a cheque and the rest of the value of the fixtures would remain as credit.

- Aug 8 Bought a new van on credit from Toyota Co. £8,700

- Aug 15 Bought office fixtures paying by cash £110

- Aug 19 Paid Toyota Co. a cheque for the whole amount of debt

- Aug 25 Paid £430 of the cash in hand into the bank account

- Aug 28 Bought new office fixtures paying via bank account £750

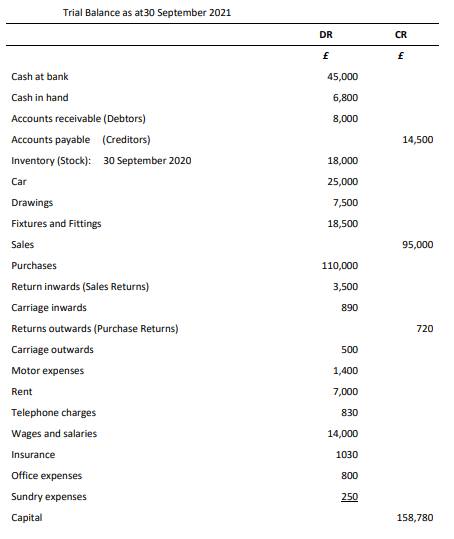

- Then balance off the accounts and extract a trial balance for sole trader B Moore. as of 30 September 2021:

Buy Answer of This Assessment & Raise Your Grades

Are you Searching for online accounting assignment help? Yes, we can provide online assignment help services in UK. We have a team of professional assignment helpers who can provide solutions to your Recording Business Transactions assignment at a pocket-friendly and this solution will be 100% Plagiarism-Free.

Answer