- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

- OTHM Level 5: J/650/1143 Research Methods in Health and Social Care

BB5112: The Providential Insurance Company has developed a list of seven investment alternatives, with corresponding financial factors: Business Decision Modelling Assignment, KUL, UK

| University | Kingston University London (KUL) |

| Subject | BB5112: Business Decision Modelling |

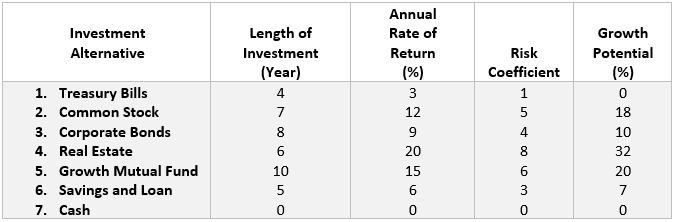

The Providential Insurance Company has developed a list of seven investment alternatives, with corresponding financial factors, for a 10-year investment horizon. These investments and their corresponding financial factors are presented in the following table. With this table, the meaning of the various financial factors is as follows:

- The length of investment – the expected number of years required for the annual rate of return to be realized, taking into account the possibility of reinvestment;

- The annual rate of return – the expected rate of return over the 10-year investment horizon;

- The risk coefficient – a subjective, dimensionless estimate representing the portfolio manager’s appraisal of the relative safety of each alternative, based on an ordinal scale of 10;

- The growth potential– a subjective estimate representing the portfolio manager’s appraisal of the potential increase in the value of the investment alternative for the 10-year period.

The Providential Insurance Company seeks to maximize the return on its portfolio of investments, subject to the following restrictions on the selection of the portfolio:

- The average length of the investment for the portfolio should not exceed 7 years

- The average risk for the portfolio should not exceed 5

- The average growth potential for the portfolio should be at least 10%

- At least 10% of all available funds must be retained in the form of cash at all times in order to maintain working capital liquidity

- The proportions of funds invested in the various alternatives must sum to 1.0.

Are You Looking for Answer of This Assignment or Essay

Task

- Using clear notation, Identify the decision variables for this problem.

- Use these decision variables to formulate the firm’s objective function, clearly stating what the objective is.

- Use the information in Tables 1 and 2 above to identify the constraints for this problem.

- Using what you have identified in 1-3 above formulate and present the complete linear programming model for this problem.

- Enter the linear programming model you have derived in 4 above into Solver to obtain the optimal solution to the problem.

- Extract the optimal solution from Solver and state the value of the objective function, and the values of the decision variables then summarise the results, making clear the contribution to the Total Rate of Return made by each investment alternative.

- Using Solver extract a Sensitivity Report for the problem.

- From the Sensitivity Report extract the slack and surplus variables and interpret their meaning.

- Using the results of the Sensitivity Report indicates whether the optimal solution to the problem is unique or if there are alternative optimal solutions.

- Present a brief interpretation of the ranging information on the objective function coefficients presented in the Sensitivity Report for this problem.

- Identify the shadow prices from the Sensitivity Report and interpret their meaning.

- Using the shadow price on the average length of investment indicates the impact on the objective function of increasing the length by 1 year. What is the upper limit of the availability of component 1 for which this shadow price is valid?

- What would be the impact of increasing the liquidity requirement by 1 percent?

Do You Need Assignment of This Question

Looking for a reliable and trustworthy essay writer UK? Look no further than Studentsassignmenthelp.co.uk! Our team of expert essay writers is ready to help you with all your academic needs. We understand the importance of deadlines, and we work hard to ensure that all assignments are delivered on time. We offer affordable prices, exceptional quality, and outstanding customer support. So, get in touch with us to get the best assignment help UK at the best prices!