- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

- OTHM Level 5: J/650/1143 Research Methods in Health and Social Care

Briefly differentiate between Direct Costs and Indirect costs in total Product Cost determination in business: Accounting and Finance Assignment, DMU, UK

| University | De Montfort University (DMU) |

| Subject | Accounting and Finance |

Assessment Brief

This multitasks written assessment has THREE tasks relating to management accounting and the use of management information for decision making. The objectives are:

- To test your understanding of the management accounting function.

- To test your knowledge of key management accounting concepts and processes.

- To test your ability to analyze and interpret financial information and use them to make appropriate business decisions.

This is a pre-seen open book assessment, and you may complete it in your own time, at any point up to the submission deadline indicated below.

Task 1

- Briefly differentiate between Direct Costs and Indirect costs in total Product Cost determination in business. Give examples if possible

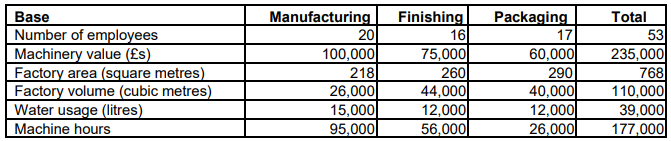

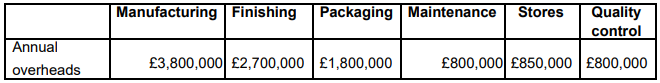

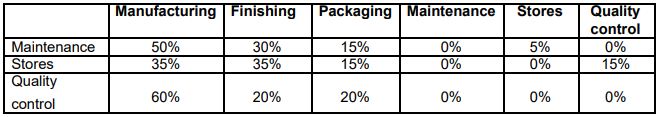

- DKM Leicester Limited manufactures Student metal beds in three production departments in their Leicester production hub: Departments are Manufacturing, Finishing, and Packaging. DKM Leicester Limited also has three service departments, namely: Quality Control, Stores, and Maintenance. The company uses an absorption costing system to analyze product costs, and you have been supplied with the following information in relation to the production departments as indicated in Table 1 below:

- DKM Leicester Limited estimates to spend £120,000 for heating the factory during the year 2022 financial year, calculate the heating cost that should be allocated to each of the three production departments.

Task 2

DKM Leicester Limited also produces special ergonomic student tables in one of their production hubs located in Manchester. The forecasts for the year 2022 are that fixed costs will be £22,000,000, variable costs per student table will be £600, and sales price will be £770 per Student table. Sales for the year are forecasted at 850,000 Student tables.

- How many Student tables will have to be produced and sold to break even in the Manchester production hub?

- Calculate the company’s margin of safety as a percentage of sales.

- The Managing Director of the Manchester production facility has declared that the profit target for the year 2022 is to be £90,000,000. How many Student tables does the facility need to make and sell to achieve that target profit?

- The Directors of DKM Leicester Limited were advised by the company’s external accountant that for the company to be successful, they have to produce beyond the breakeven point. However, the directors do not understand what the accountant meant by the term ‘Break Even Point’. Provide a brief note for the directors that explains what the ‘Break Even Point’ means.

Task 3

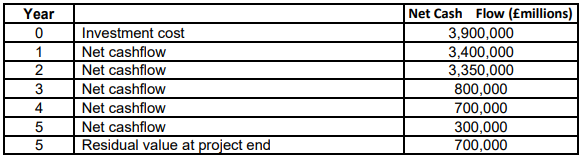

The directors of DKM Leicester Limited are considering investing in producing a Student Covid-19 vaccine testing kit to tackle the new Omicron variant in the UK. The project is estimated to have the following cash flows in the five (5) year period, and the company has the required rate of return at 18%.

- What is the payback period for the project?

- Calculate the Accounting Rate of Return for the project

- Calculate the Net Present Value of the project.

- Based on the NPV calculation, advise the directors of DKM Leicester Limited whether or not they should undertake the project?

- List four advantages of the NPV investment appraisal technique.

Are You Looking for Answer of This Assignment or Essay

UK Assignment Help is the top university assignment help online in the UK. our experienced writers have vast experience to offer fresh and original answers related to finance and accounting assignment at a market price.