- D/618/7406 Unit 5: Challenges of IT Security in Modern Organizations – Risks, Solutions & Best Practices

- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

CA6060 An airline wants to buy an aircraft and has narrowed down investment options to two alternative aircraft types: aviation Assignment, LMU, UK

| University | London Metropolitan University (LMU) |

| Subject | CA6060 FINANCIAL DECISION MAKING(In context for Aviation |

Overview and Task

CA6060 ASSIGNMENT 2

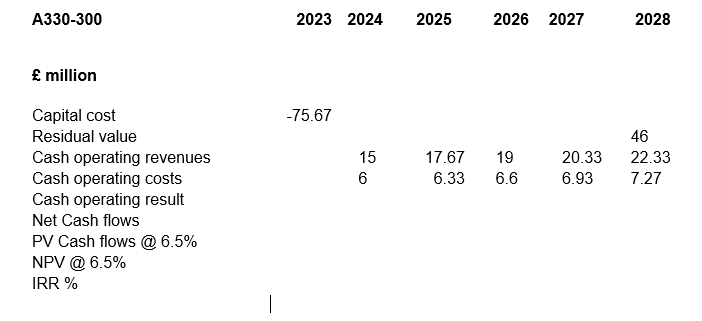

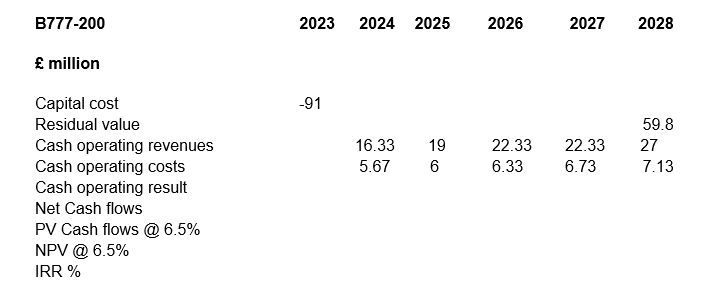

Q1. An airline wants to buy an aircraft and has narrowed down investment options to two alternative aircraft types: the acquisition of a new A330-300 for £75.67m versus a new Boeing 777-200 for £91m. The aircraft have got similar passenger capacity and each will perform the required services between specified or likely future city pairs. Where there is a difference in payload or cargo capacity, this will be reflected in the revenue forecasts.

Are You Looking for Answer of This Assignment or Essay

TASK:

- Complete the investment appraisal cash flow above (NPV, IRR e.t.c)

- b) Calculate the payback period for each aircraft (4 marks)

- c) Calculate the profitability index (please include formula and working). What are the advantages and disadvantages oF using this measure as an appraisal tool?

- d) Draw a graph of NPV against discount rate for rates between 0 to 16% (in steps of 2 i.e. 0,2,4 etc.)

- Using the above information and any other characteristics of these aircraft, which aircraft would you advise the airline to buy and why if the cost of capital is not expected to go over 10%? You should explain with the help of a sensitivity analysis.

- An airport is considering investing in a machine, which, will cost £9000 and will generate positive cash flows over the next four years as follows:

| Year | T1 | T2 | T3 | T4 |

| Cash flow(£) | 1200 | 2300 | 3400 | 4600 |

You can depreciate the asset using a straight-line method.

- Work out the annual accounting profits and then the average ROCE (Return on capital employed) to 1d.p.

- What are the advantages and disadvantages of using ROCE as an appraisal method?

- No matter which method of appraisal is applied, the users must be aware of its strengths as well as its shortcomings.

- Discuss this statement using IRR and payback period as examples.

Do You Need Assignment of This Question

In search of online assignment help UK or the finest Finance Assignment Help UK? Our service is finely tuned to aid students at London Metropolitan University (LMU), specifically focusing on subjects like CA6060 FINANCIAL DECISION MAKING (In context for Aviation).

Students can conveniently pay our experts for valuable guidance in their coursework. Whether it’s the evaluation of investment options for an airline’s aircraft purchase or delving into the intricacies of the aviation assignment, our support ensures that LMU students thrive in their Aviation Assignments.