- D/618/7406 Unit 5: Challenges of IT Security in Modern Organizations – Risks, Solutions & Best Practices

- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

CMSE11101: An investor has collated nine returns from their portfolio andCalculate the following for each asset class: Advanced Management Accounting Assignment, TUE, UK

| University | The University of Edinburgh (TUE) |

| Subject | CMSE11101: Advanced Management Accounting |

Question 1.

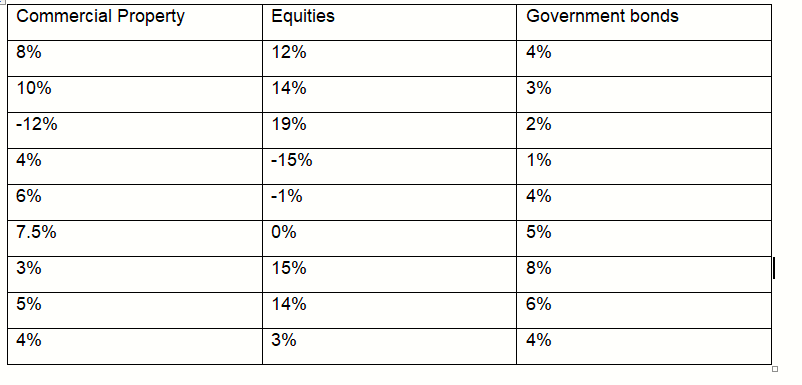

a) An investor has collated nine returns from their portfolio. Calculate the following for each asset class; mean, median, mode, variance, and standard deviation. Show your workings and briefly comment on your results

Table 1. Returns in 2022 for Commercial Property, Equities, and Government Bonds

Q1b) Using the information in Table 1, calculate the correlation between Equities and Commercial properties. Comment on the implications of your correlation calculation if you wanted to diversify a portfolio that contained both 50% weight in commercial property and 50% inequities.

Question 2.

Describe and explain how a company can manage working capital? Provide the equation that is used to calculate the net working capital and why it is useful for a company to calculate net working capital? Please give one real-world example of a company managing its working capital.

Question 3.

Critically evaluate the advantages and disadvantages of the Value at Risk (VaR) risk measurement? Then, compare and contrast the marginal VAR (M-VaR), incremental VaR (I-VAR), and the Component Var (C-VaR).

Question 4.

Describe the concept of arbitrage, and provide an example of when a company has conducted arbitrage in the past.

Question 5.

Consider a stock currently trading at $50. The periodically compounded interest rate is 3%. Suppose that U = 1.3, and D = 0.8. Calculate the value of a two-period European-style put option on the stock that has an exercise price of $50. Also, determine if early exercise would make economic sense.

Are You Looking for Answer of This Assignment or Essay

If you are looking for someone to pay for college assignments, then you have come to the right place. StudentsassignmentHelp.co.uk has a bunch of experienced and skilled writers to ensure that written solutions for accounting assignments will be 100% plagiarism free as per university standards.