- D/618/7406 Unit 5: Challenges of IT Security in Modern Organizations – Risks, Solutions & Best Practices

- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

Demonstrating sound knowledge and understanding of relevant legal principles and rules: Business Law Assignment UOL,UK

| University | University of Law (UOL) |

| Subject | Business Law |

BUSINESS LAW 2 COURSEWORK

On submitting this Assessment you will be deemed to have completed the following declaration: “I declare that this is my own unaided work and if this statement is untrue I ACKNOWLEDGE that I have cheated.”

INSTRUCTIONS TO CANDIDATES

- Type your candidate number on each page of your answer and follow the submission instructions as directed by The University of Law.

- Your submitted work must be in Word. You must state your word count at the end of your answer. The total word count for all questions must NOT exceed 2000 words.

- You must reference your work using OSCOLA even if you would not normally do so for the types of matter in question (such as producing a client letter or e-mail).

- The assessment is marked out of 100. There is no specific allocation of marks to the separate questions. At Level 6, it is a matter for your judgement as to the relative weight you give to each question, so you will not receive any guidance on how to allocate your word count between the different parts of it.

For this Assessment you will be assessed against these Assessment Criteria:

- Demonstrating sound knowledge and understanding of relevant legal principles and rules.

- Presenting an answer, advice or opinion using an appropriate structure, including analyzing factual materials to identify relevant legal issues, applying the relevant law to the facts, reaching a logical conclusion or, where appropriate, evaluating a range of solutions to give advice or an opinion.

- Selecting relevant primary and secondary sources to support an answer.

- Critically evaluating topics, arguments and cases with reference to policies and abstract concepts and expressing sustainable views on areas where the law appears to be controversial or uncertain.

- Managing time effectively to produce complete answers under assessment conditions.

- Expressing an answer, advice or opinion clearly and concisely, using correct grammar and spelling and using appropriate technical legal language where relevant.

- The contents of this Assessment are confidential. You must not disclose, discuss or express an opinion on the contents of this Assessment or your answer to it to any other person, by any means.

In particular, you should note that you may not consult any member of The University of Law staff nor any other person on any aspect of the content of this Assessment. If you are in any doubt as to how to interpret any word or phrase in this Assessment you should decide for yourself which interpretation to adopt.

By submitting this Assessment you are confirming that you are fit to sit, in accordance with the Assessment Regulations.

CASE STUDY

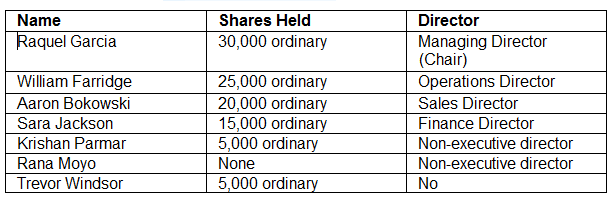

Your firm acts for Fair church Communications Limited (“Fair church”), a company incorporated on 5 May, 2014. Fair church is a company that supplies communication infrastructure and associated goods and services. It has an issued share capital of 100,000 ordinary £1 shares, all of which are fully paid.

Fair church has adopted the Model Articles for Private Companies Limited by Shares, without amendment

Do You Need Assignment of This Question

QUESTION 1

PART A

Fair church has been successful and has maintained healthy sales and profits during the pandemic. The board of directors now has plans to expand the business, but Fair church does not currently have the cash reserves to achieve its aims. The board has therefore been seeking funding from various possible sources, and Raquel has had discussions with her brother, Ryan, who has agreed to invest £100,000 into Fair church in return for the allotment to him of 20,000 £1 ordinary shares (on the basis that the shares have now been valued at £5 per share).

In addition (and on the same basis), William has agreed to invest a further £10,000 in return for the allotment to him of an additional 2,000 £1 ordinary shares.

Sara and Trevor are opposed to the allotment of shares to Ryan as they do not agree with the board’s expansion plans and do not want to see an “outsider” introduced into the company. They therefore intend to do all they can to block the proposed allotment of shares to both Ryan and William and will attend any meetings to put forward their views. Krishna is presently inclined to support Sara and Trevor; however, Raquel is confident that she can persuade him to change his mind. All the other directors are in favor of the proposal.

Your firm has been consulted by Raquel to advise on the implementation by Fair church of the proposal to allot the shares to Ryan and William on the above terms, to take effect as soon as possible. She has already called a board meeting to take place four days from now, when everyone will be in the office and can and will attend.

You have been instructed by your supervisor, Sandy Wright, to prepare a memorandum in which you must:

Explain whether any shareholder resolutions are required; and

Set out a plan of the procedure necessary to allot the shares to Ryan and to William.

You should include in your procedure plan:

all the decisions that must be taken by the directors and/or shareholders.

If any shareholder resolutions are needed, the written resolution procedure rather than the procedure for a general meeting.

Any related requirements of the Companies Act 2006 and Fairchurch’s articles which must be complied with.

However, you are instructed NOT to include details of notice of the board meeting already called by Raquel, or any external filings or internal administration which must be dealt with as a consequence of the allotment.

Buy Answer of This Assessment & Raise Your Grades

PART B

Assume for the purposes of this question that the proposal to allot the shares to Ryan and William has been implemented.

Fair church is proceeding with its expansion plans. However, concerned about the cost and likely success of those plans, Sara Jackson chose to leave the company shortly after the allotment of the shares to Ryan and William. The board was able to identify another new investor, who agreed to buy her 15,000 shares for £75,000. After the sale of her shares was completed, Sara resigned as a director of Fair church.

Sara is now seeking advice concerning her tax affairs.

She is a higher rate taxpayer for income tax purposes. So far, during the tax year 2021/2022, she has sold the following assets:-

- Her 15,000 shares in Fair church.

- 10,000 shares in Tesco plc for £22,300. She bought them for £27,700 in October 2018.

- 20,000 shares in clothing manufacturer, Charles Stanton Fashion Limited (“Stanton”), in which she has been a director and shareholder since 1 November, 2020. She realized a gain of £6,000 on the sale.

Sara has no plans to make any further disposals during this tax year.

Using the 2021/2022 tax rates, calculate and explain Sara’s total capital gains tax liability arising from the sale of her shareholdings in Fairchurch, Tesco plc and Stanton.

Note:

Summary of main capital gains tax rates and allowances for 2021/22:

Standard Rate: 10%

Higher Rate: 20%

Surcharge: 8%

Annual Exemption: £12,300

QUESTION 2

On 1 June, 2021, Fair church contracted to supply some equipment to a new customer, Coronet Metric Ltd. (“Coronet”). Delivery was made to Coronet on 5 June, 2021 and an invoice was submitted at the same time for payment of the price of £35,000 (Inc. VAT) within 14 days of delivery. Whilst Coronet has not disputed the debt, it has so far paid only £5,000 to Fair church and it is not showing any signs of settling the balance of the debt soon. Fair church has contacted your firm for advice. Raquel Garcia believes Coronet is currently suffering severe financial problems.

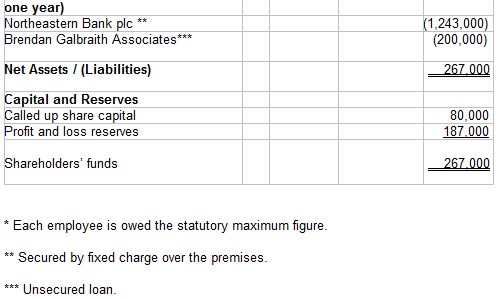

Document A is a balance sheet for Coronet as at 30 June, 2021. The following additional information is also relevant:

- The freehold premises were last formally valued in July 2017, and this is the value recorded in Document A. However, as at today’s date, the premises are in fact worth approximately £1,300,000.

- In a liquidation at any time in the foreseeable future, the stock would realise only 50% of the value shown in Document A.

- One of Coronet’s largest customers has just gone into insolvent liquidation owing Coronet £125,000, with little prospect of its unsecured creditors (including Coronet) receiving payment of their debts.

So far, none of Coronet’s creditors has served statutory demands or commenced court proceedings in relation to debts which are already due for payment.

For the purposes of this question, you can assume that the information in Document A remains correct for all items, other than as referred to in (I) – (III) above.

(a) Using the above information and the information in Document A, explain whether Fair church could petition for a compulsory winding-up of Coronet on the basis of the “balance sheet test” of insolvency.

(b) Assume for the purposes only of this part (b) that Brendan Galbraith Associates successfully petition for the compulsory winding-up of Coronet. On the basis that all the information at (I) – (III) above is correct, explain (with calculations) how much Fair church will receive of the debt owed to it if the costs of the liquidation amount to £25,000.

Are You Looking for Answer of This Assignment or Essay

If you want to finish your Management assignment? Don’t panic students assignment help is the best place in the UK We provide the best management assignment. you just hire Our experts to write your business law assignment at cheap prices and they always write your assignment according to university formation & guidelines.