- D/618/7406 Unit 5: Challenges of IT Security in Modern Organizations – Risks, Solutions & Best Practices

- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

ECM313: Outline the difference between systematic and unsystematic risk: Financial markets, Assignment, UOL, UK

| University | University of London (UOL) |

| Subject | ECM313: Financial markets |

Question 1

https://www.studentsassignmenthelp.co.uk/finance-assignment-help/(i) Outline the difference between systematic and unsystematic risk.

(ii) Explain the meaning of beta. State the equation for the Securities Market Line (SML). If a share lies under the SML is it overvalued or undervalued by the market (assuming the CAPM is correct)?

Question 2

(i) Calculate the Macaulay Duration for an £10 annual coupon bond with 6 years left to maturity if the bond’s yield to maturity is 6%. The face value of the bond at maturity is £100. (Show your calculations)

(ii) What is the modified duration of the bond?

(iii) Calculate the current price of the bond set out in part (i)

(iv) If 6 year yields to maturity were to suddenly fall from 6% to 4%. Based on the price calculated in part

(iii) what would you expect the bond price to be after the yield falls to 4% ? (Show your calculations)

Question 3

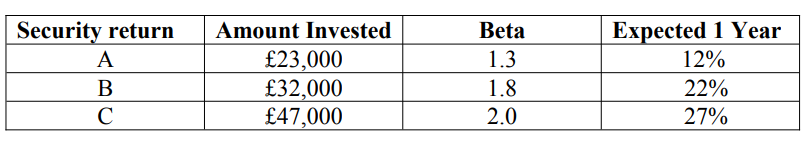

You have following investments in securities A, B and C

The current risk-free rate of interest is 5% and you have heard that analysts are expecting a 15% return on the market portfolio over the next year. Based on your expectations for the 1-year returns of each of the securities is your portfolio underpriced, overpriced or correctly priced?

Question 4

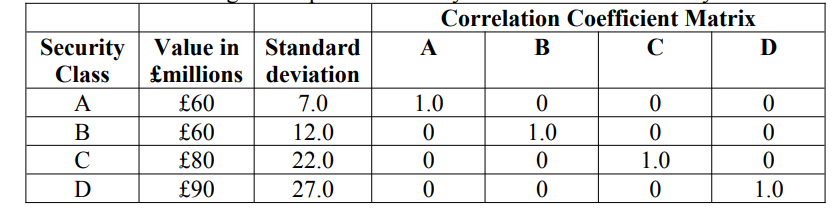

Assume that the following data represent all risky securities in the economy

i. ) What is the market portfolio i.e. what percentage of each security must be invested to achieve the market portfolio? What is the standard deviation of the market portfolio?

ii. ) If the risk-free rate of return is 3% and the expected return on the market portfolio is 11%, what are the Capital Market Line and Security Market Line equations?

iii. )A pension fund that you are advising wishes to have an expected rate of return of 14%. How should the fund invest to obtain this? What would be the standard deviation and the beta of the pension fund’s portfolio?

Do You Need Assignment of This Question

Question 5

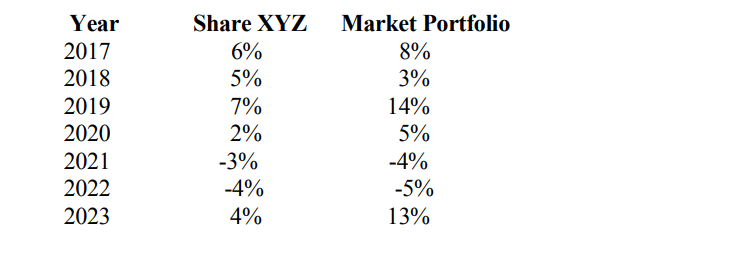

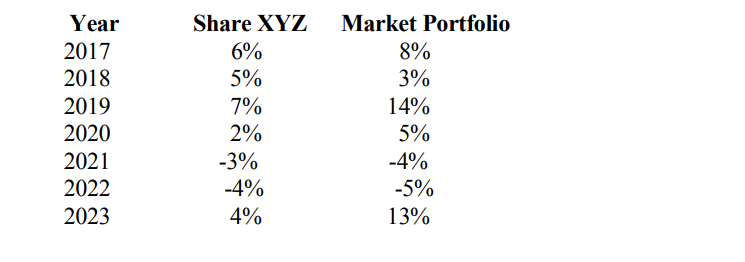

You have the following 7 years of data covering returns on shares of Company XYZ and the Market Portfolio

The standard deviation of share XYZ is 3.75

The standard deviation of the market portfolio is 6.25

The covariance of XYZ with the market is 19.5

(i) Calculate for each of the above years, the yearly returns of a portfolio created by allocating your money 40% between share XYZ and 60% the market portfolio.

(ii) Calculate the average expected rate of return and standard deviation of a portfolio made up of 40% share XYZ and 60% in the market portfolio

(iii) Calculate the beta of share XYZ. What does the beta reveal about the defensive or aggressive qualities of share XYZ?

Buy Answer of This Assessment & Raise Your Grades

Question 6

You are an equity analyst working for an investment bank. You are analysing

Company ABC shares. The last year’s dividend (Do) was 40 pence. You are predicting a 6% dividend growth for next 3 years and 9% for the following 2 years, and thereafter dividend growth is assumed to slow for the foreseeable future to 5%. The required rate of return on equity is deemed to be 13%.

i. Calculate the fair value price of the share.

ii. What is the fair value of the share at the end of year 5?

Question 7

The policy-making committee of Bank ABC recently used reports from its securities analysts to develop the following efficient equity only portfolios.

i. If the risk free rate of interest is 4% which portfolio is best?

ii. Assume that the policy-making committee would like to earn an expected rate of return of 25% with a standard deviation of 16, is this possible?

iii. If a standard deviation of 22 was acceptable to the investment committee,

what would be the expected return and how could it best be achieved?

iv. Assume that the correlation coefficient between all of the above portfolios is zero. What is the expected rate of return on a combined portfolio made up of

all the above 5 portfolios with an equal weighting given to each portfolio?

Would the standard deviation of this combined portfolio be higher or lower

than that of portfolio 4 or is it not possible to say?

Buy Answer of This Assessment & Raise Your Grades

Question 8

You are given the following data on the 3-month sterling interest rate futures contract. The contract has a notional size of £1 million.

Sterling futures contract 96.60

i. Explain what the sale of such a contract implies.

ii. If you think 3-month interest rates in September 2024 will be 8% would you buy or sell the contract? Explain your reasoning and the profits you can expect if you are correct.

iii. Briefly explain how a Corporate Treasurer who is looking to lend £1

million of funds for 3 months from September 2024 might use the above contract to hedge interest rate risk.

Question 9

(i) The spot exchange rate is $1.25/€1, the Euro interest rate is 4%, the US interest rate is 6% and the time left to expiry of the June 2024 dollar per euro futures contract is 120 days. Based on a 360 day trading year what is an appropriate price for the March 2024 dollar per euro future exchange rate? Comment on whether the dollar is at a futures premium or discount.

(ii) The Dow Jones cash index is reading 30,000, the US risk free rate of interest is 6% and the dividend yield on the Dow Jones stocks is 3% per annum. Calculate an appropriate “fair value” for the June 2024 Dow Jones index futures contract assuming that the time left to expiration is 170 days based on a 365 trading year. Comment on whether the Dow Jones index futures contract is at a premium or discount to the cash market.

Question 10

(a) It is January 1, 2024, the 3 month (91 days) $LIBOR spot interest rate is 6% and the 6 month (182 days) $LIBOR spot interest is 7%. Calculate the appropriate price of the March 31, 2024 $LIBOR interest rate futures contract.

(b) Explain the rationale behind your result given that the contract size is for $1

million.

Question 11

The December 2024 FTSE 100 stock index futures contract is reading 7400 while the cash index is reading 7600. The futures contract is worth £25 per point.

i. Is the dividend yield higher or lower than the risk free rate of interest?

ii. You have £80 million of funds invested in FTSE 100 stocks under

management and are concerned about a fall in the market by December

expiration to 6500. Describe the hedging strategy that you may adopt to

protect your fund against such a fall.

iii. You are optimistic about the market prospects and predict that the FTSE 100 index will be reading 8200 by expiration. Describe a speculative strategy

using the futures contract that you would adopt and the risks that you run.

Question 12

You are given the following information about the stock of Company ABC:

Share price $82 risk free rate of interest is 4%, time to expiration is 6 months,

annualised standard deviation is 0.6 and exercise price is $87.

i. Calculate the appropriate call value of the stock according to the Black Scholes option pricing formula.

ii. Calculate an appropriate put premium.

Question 13

(i) The spot exchange rate is $1.25/€1, the Euro interest rate is 3.2%, the US interest rate is 5% and the time left to expiry of the July 2024 dollar per euro futures contract is 200 days. Based on a 365 day trading year what is an appropriate price for the July 2024 dollar per euro future exchange rate? Comment on whether the dollar is at a futures premium or discount.

(ii) The Dow Jones cash index is reading 18,600, the US risk free rate of interest is 4% and the dividend yield on the Dow Jones stocks is 2% per annum. Calculate an appropriate “fair value” for the July 2024 Dow Jones index futures contract assuming that the time left to expiration is 200 days based on a 365 trading year. Comment on whether the Dow Jones index futures contract is at a premium or discount to the cash market.

Question 14

Discuss whether the following statements are True or False. Explain your reasoning in each case.

(i) Investors demand higher expected rates of return on stocks with more

systematic risk.

(ii) The CAPM predicts that a security with a beta of 0 will offer a zero

expected return.

(iii) An investor who puts $10,000 in Treasury bills and $20,000 in the market

portfolio will have a beta of 2.0.

Question 15

In March 2024 Apple shares are priced at $180 a share. You believe that they are considerably overvalued and are worth only $65 a share. June 2024 the put option premium at a strike price of $140 a share are currently priced at $4 per share. Each put contract is based on 100 shares.

(i) What is the intrinsic value of the put option per share? (1 mark)

(ii) What is the time value of the put option per share? (1 mark)

(iii) What is your net dollar profit (+) or loss (-) as a holder of the put contract (based on a contract size of 100 shares) if we arrive at expiry in June and you are wrong and Apple shares are selling for $200?

Are You Looking for Answer of This Assignment or Essay

Need assistance with your financial markets assignment? Our assignment writing help in the UK is available to make your life easier! If you’re asking, “Who can do my assignment for me?” look no further; our expert writers are here to deliver. We also specialize in providing help with finance assignments to ensure you achieve great results. UK students can simply pay our experts for the academic support they need. Get in touch today!