- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

- OTHM Level 5: J/650/1143 Research Methods in Health and Social Care

- Feasibility Study for Night Moves: Event Logistics at Finsbury Park, Assignment 2

- EU Law: Dominant Undertakings & EU Four Freedoms – Legal Implications and Market Impact

FIN6003 Delta Ltd wishes to calculate its current cost of capital for use as a discount rate in investment appraisal: Financial Management Assignment, AU, UK

| University | Arden University (AU) |

| Subject | FIN6003 Financial Management Assignment |

Question 3

Delta Ltd wishes to calculate its current cost of capital for use as a discount rate in investment appraisal. The following financial information relates to Delta Ltd:

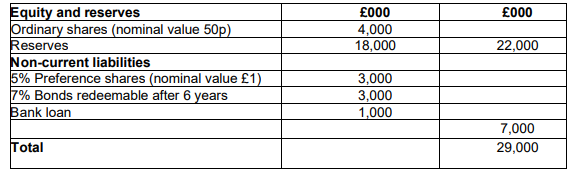

Financial Position statement extracts as at 31 December 2022

Are You Looking for Answer of This Assignment or Essay

The ordinary shares of Delta Ltd have an ex-div market value of £4.70 per share and an ordinary dividend of £0.36 per share has just been paid. Ordinary dividends are expected to grow in the future by 4% per year.

The preference shares of Delta Ltd are not redeemable and have an ex-div market value of £0.40 per share.

The 7% bonds are redeemable at a 5% premium to their nominal value of £100 per bond and have an ex-interest market value of £104.50 per bond.

The bank loan has a variable interest rate that has averaged 4% per year in recent years.

Delta Ltd pays profit tax at an annual rate of 19% per year.

Required:

a) Calculate the market value Weighted Average Cost of Capital (WACC) of Delta Ltd.

b) Discuss the pros and cons of using the WACC as a discount rate to evaluate capital budgeting projects.

c) Explain the impact of tax on the WACC according to the modified Modigliani & Miller (M&M II, 1963) capital structure model.

Are You Looking for Answer of This Assignment or Essay

Elevate your academic experience with our tailored support – Assignment Helper UK and specialized Finance Assignment Help Services in the UK. Crafted for students at Arden University (AU), our expertise extends to Financial Management, focusing on the intricacies of FIN6003.

Explore the challenge faced by Delta Ltd as they aim to calculate their current cost of capital for use as a discount rate in investment appraisal. UK students seeking guidance can invest in their academic success by leveraging our expert assistance. Simplify financial complexities, ensure excellence, and advance confidently in your coursework with our dedicated support.