- D/618/7406 Unit 5: Challenges of IT Security in Modern Organizations – Risks, Solutions & Best Practices

- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

In 2021 the company purchased direct raw material RM45,000, and direct labor cost RM31,000: corporate finance Assignment, QMUL, UK

| University | Queen Mary University of London (QMUL) |

| Subject | Corporate Finance |

CORPORATE FINANCE TEST (25%)

QUESTION 1

Explain 4 (FOUR) quality cost with examples. (10 marks)

QUESTION 2

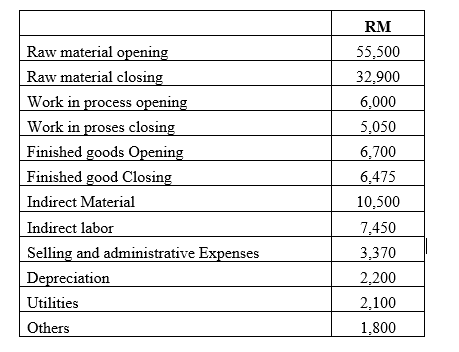

In 2021 the company purchased direct raw material RM45,000, and direct labor cost RM31,000. Prepare Cost of goods sold schedule for the company.

Buy Answer of This Assessment & Raise Your Grades

QUESTION 3

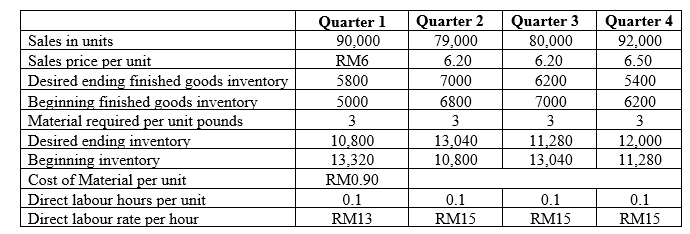

Using above information prepare following budget:

- Production budget

- Direct material Budget

- Direct labor budget

QUESTION 4

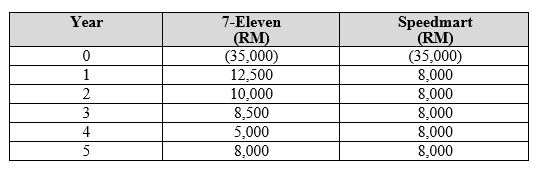

Belton Sdn Bhd is considering one of the two mutually exclusive projects, 7-ELEVEN and SPEEDMART. The company’s discount rate is at 6%. The expected after tax cash flows for both projects are as follows:

As the company’s financial manager, you are required to:

- Calculate the payback back period for project 7-Eleven and

- Calculate the Net Present Value for project 7-Eleven and

- Calculate the Internal rate of return for p project 7-ELEVEN and Speedmart.

- Determine the best project that Belton Sdn Bhd should invest Justify your answer.

Are You Looking for Answer of This Assignment or Essay

Struggling with your Corporate Finance Assignment in the UK? Our assignment writing help UK service specializes in Finance Assignment Help for UK students. Delve into the intricacies of financial transactions like direct raw material and labor costs without stress.

Pay our experts for invaluable assistance, allowing you to focus on mastering the subject. Let us guide you through this assignment, ensuring your academic success effortlessly. Trust our expertise and excel in your studies!