- D/618/7406 Unit 5: Challenges of IT Security in Modern Organizations – Risks, Solutions & Best Practices

- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

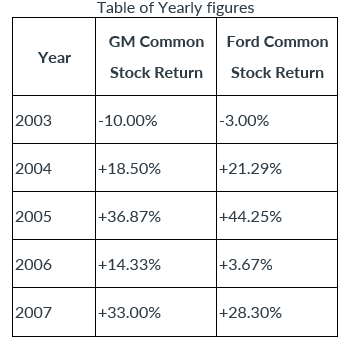

In the New York Stock Exchange (NYSE), the common stocks of General Motors (GM) and Ford (F) are recorded historically below: business management Assignment, UO, UK

| University | University of Oxford (UO) |

| Subject | Business Management |

Financial Insights and Business Intelligence

In the New York Stock Exchange (NYSE), the common stocks of General Motors (GM) and Ford (F) are recorded historically below.

Required tasks in 1500 words using the table of the yearly figure above:

As a capital-budgeting manager at NYSE, you are required to calculate the following task for advising your client:

- Estimate the average rate of return of each stock individually.

- If your client invested in a stock portfolio comprising 40% of GM common stocks and 60% of Ford common stocks, what would have been the rate of return on the asset portfolio each year?

- What would have been the average return on the portfolio during the period from 2003 to 2007?

- Estimate the (individual) risk of each stock.

- Calculate the risk for the asset portfolio (both common stocks taken together).

- What is the coefficient correlation between the returns of the two common stocks?

- Critically discuss the modern portfolio theory, which was pioneered by Harry Markowitz, in relation to your findings and advise your client accordingly in layman’s terms on the profitability of your client’s asset portfolio.

Are You Looking for Answer of This Assignment or Essay

Seeking for assignment help for UK students? Our tailored services cater to the University of Oxford (UO) with specialized Online Business Assignment Help for Business Management tasks. Specifically, we analyze historical records of General Motors (GM) and Ford (F) common stocks in the New York Stock Exchange (NYSE). UK students can trust our expertise, paying for expert guidance to excel in their coursework at UO effortlessly.