- D/618/7406 Unit 5: Challenges of IT Security in Modern Organizations – Risks, Solutions & Best Practices

- HSC Level 2/3 Unit 012 Assignment: Care Worker Responsibilities and Ways of Working

- CIPD Level 5HR03 Assignment: Understanding Reward Approaches and Their Impact on Performance and Contribution

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- PGM216D Assignment: Bicycle Store Sales Management Application

- MATH6033 Assignment: Epidemiological Investigation of Cardiovascular Health and Tea Consumption Risks

- EH6147 Assingment: Stakeholder Analysis for Quality Improvement in Hand Hygiene Compliance

- Assignment: Investigation of Solution Concentration Through Standard Preparation, Titration, and Colorimetry Techniques

- MATH6033 Assignment: Cardiovascular Risk and Tea Drinking: Epidemiological Analyses

- CIPD level 3 3CO03 Assignment: Core behaviours for people professionals

- DAC4B1: Personal development in adult care settings

- Unit 19 Research Project Assignment 1: Impact of Corporate Social Responsibility on Business Success & Community Wellness

- EG5022 Assignment: Georeferencing and Accuracy Assessment of a Quarry 3D Model Using Photogrammetric GCPs

- Assignment: Financial Performance and Strategic Analysis of a UK Listed Company: A CORE Evaluation and Reflective Review

- 5CNMN002W Assignment: Advanced measurement- Major measurement taking off

- K/650/2298 Level 3 Understanding Roles, Responsibilities, and Effective Partnerships in Health and Social Care

- Understanding Information and Knowledge Management in the Workplace: A Briefing for HR Professionals

- HRM7010D Strategic Use of People Analytics in Enhancing Organisational Value and Agility

- TOWN1060 Urban Planning in the UK History Sustainable Design and Future City Development

Mr and Mrs Netyu run a private company, Netyu Toys Ltd. Toys are imported from China: Financial Accounting Assignment, UOL, UK

| University | University of London (UOL) |

| Subject | Financial Accounting Assignment |

Question 1

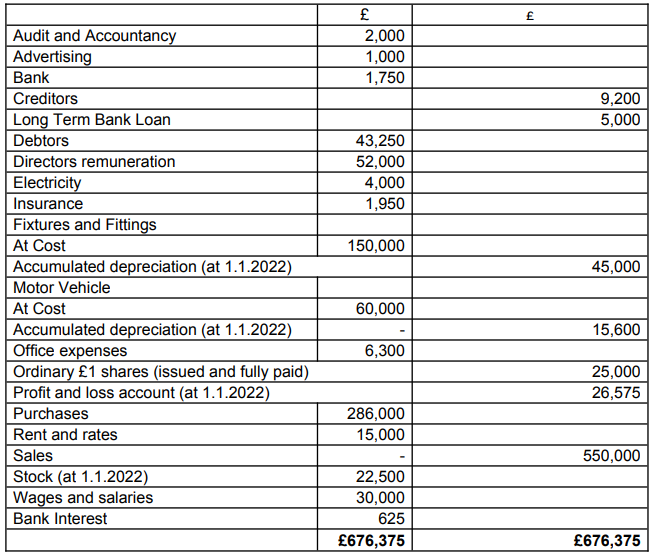

Mr and Mrs Netyu run a private company, Netyu Toys Ltd. Toys are imported from China. Mr Netyu has asked you to prepare set of financial statements for the year ended 31 December 2022 as soon as possible. The company’s accountant had to take time off due to health issues. The following balances have been extracted from the records of the company for the year ended 31 December 2022.

Do You Need Assignment of This Question

1. 2. Stock at 31st December 2022 valued at cost amounted to £22,500.

3. Depreciation is to be provided on fixtures and fittings at 15% on cost, and

at 20% on reducing balance method for motor vehicle.

4. Provision is to be made for rent and rates for £1725.

5. Insurance paid in advance at 31st December 2022 was £500.

Required

1. Prepare Income statement for the year ended 31st December 2022

(10Marks)

2. Prepare Balance Sheet as at 31st December 2022. (15

Marks)

3. Identify FIVE accounting concepts that have been applied in the

preparation of financial Statements and explain their meaning.

Buy Answer of This Assessment & Raise Your Grades

Looking for top-notch Finance Assignment Help UK? Look no further! Our platform specializes in offering Assignment Help UK to University of London (UOL) students. Specifically catering to the intricacies of Financial Accounting assignments, we assist students like you in comprehending complex topics.

Whether it’s analyzing cases like Mr and Mrs Netyu’s business, Netyu Toys Ltd., importing toys from China, or any other challenging subject matter, our experts are here to provide comprehensive guidance. Pay our experts for reliable assistance and excel in your coursework stress-free!